S Corp Balance Sheet Example - But what if the underlying. Does an s corp have to file a balance sheet? An s corp balance sheet includes a detailed list of your company's assets and liabilities. Massaging of the equity section of your balance sheet is required when being taxed as an s corporation. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. Near the end of the post, i briefly mentioned schedule l,. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then.

Massaging of the equity section of your balance sheet is required when being taxed as an s corporation. An s corp balance sheet includes a detailed list of your company's assets and liabilities. But what if the underlying. Does an s corp have to file a balance sheet? Near the end of the post, i briefly mentioned schedule l,. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for.

Near the end of the post, i briefly mentioned schedule l,. Massaging of the equity section of your balance sheet is required when being taxed as an s corporation. But what if the underlying. An s corp balance sheet includes a detailed list of your company's assets and liabilities. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. Does an s corp have to file a balance sheet?

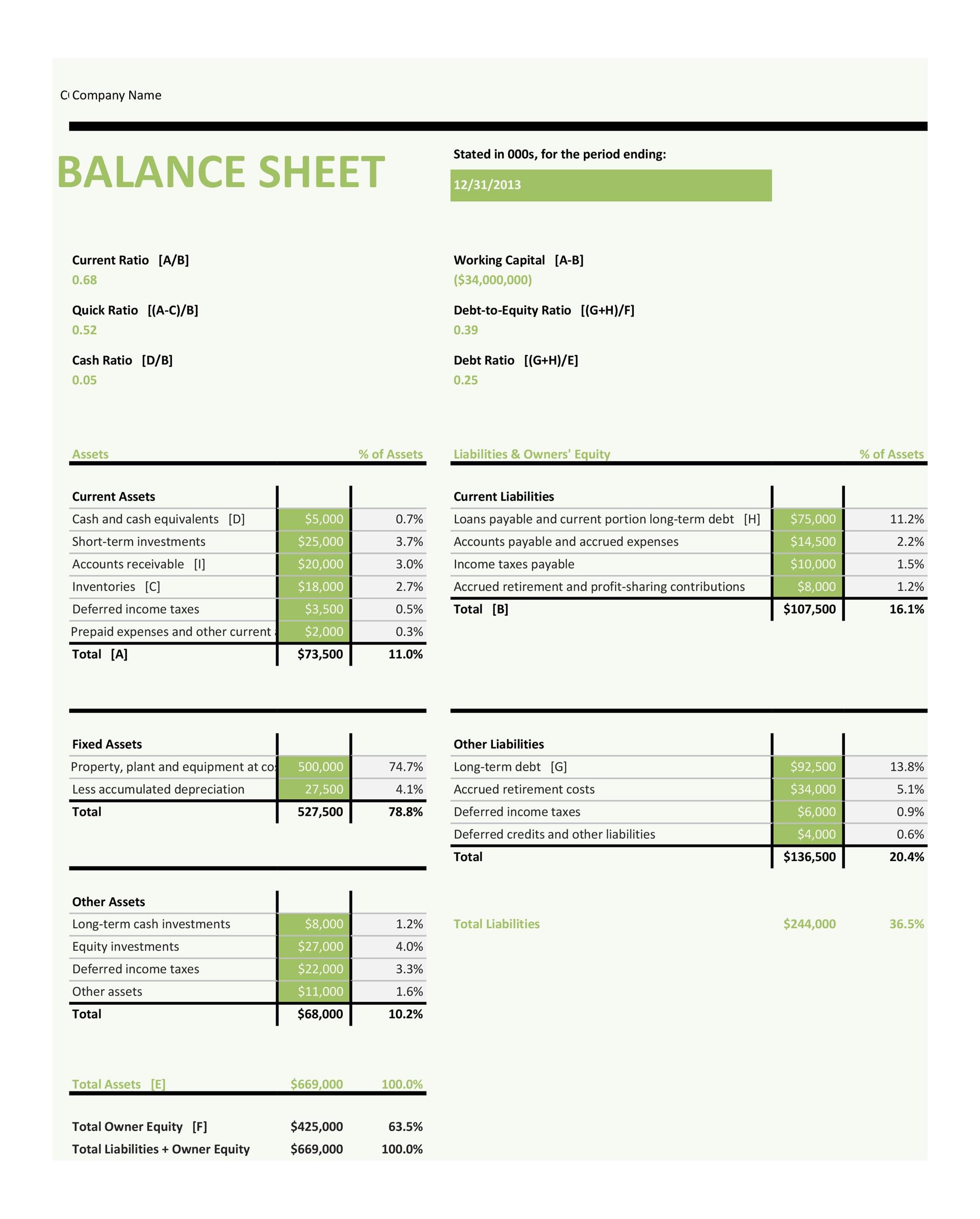

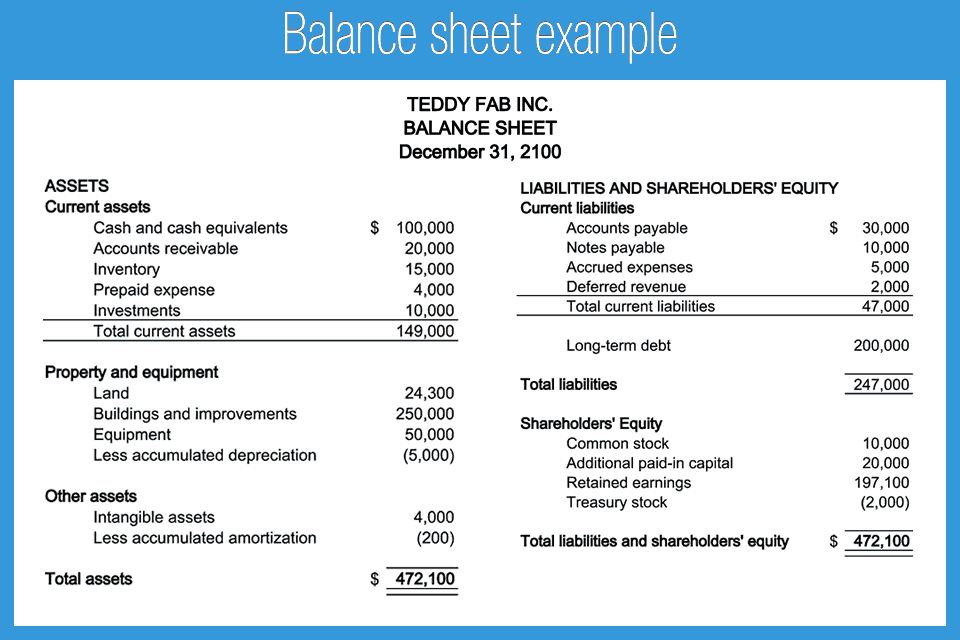

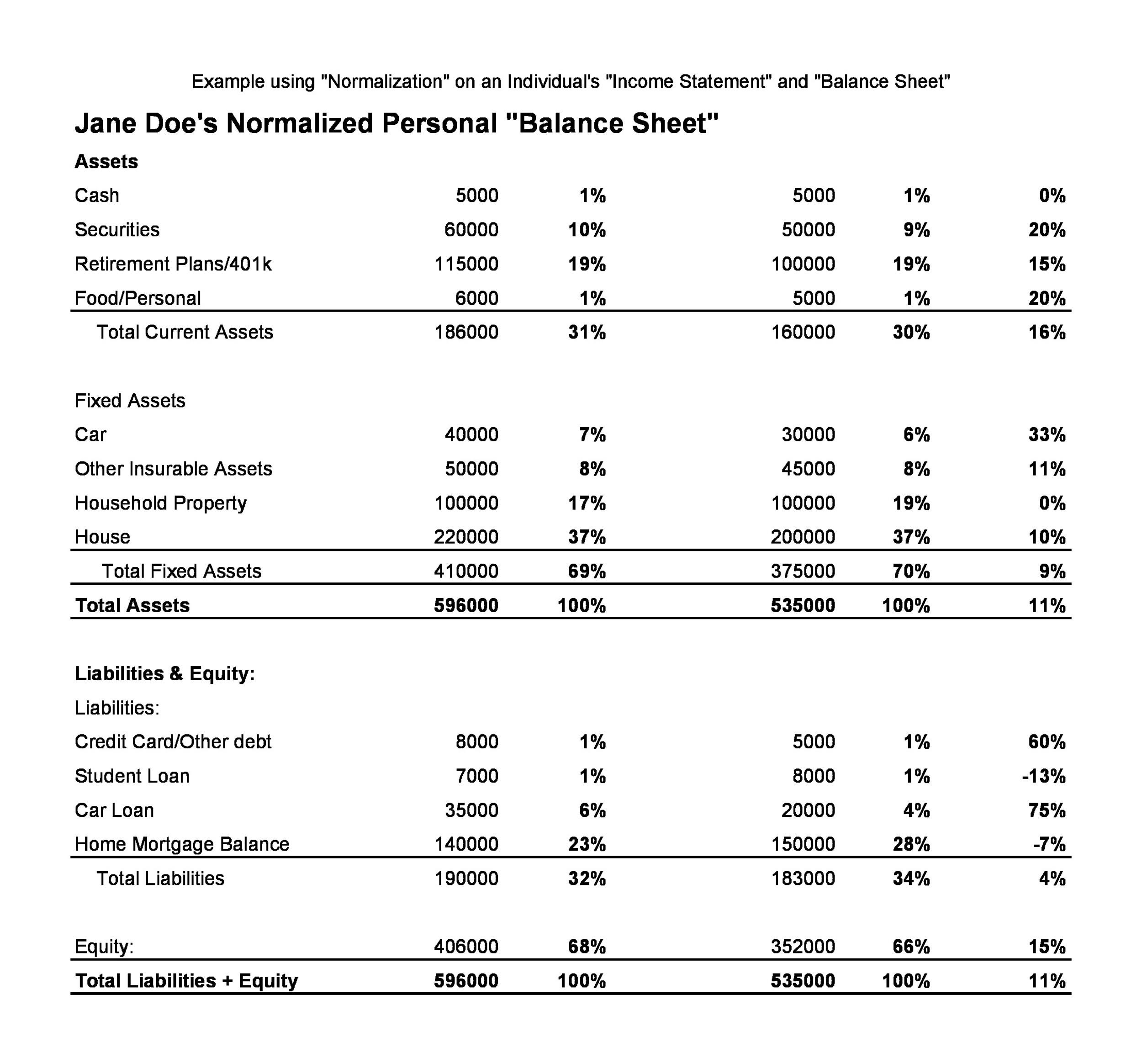

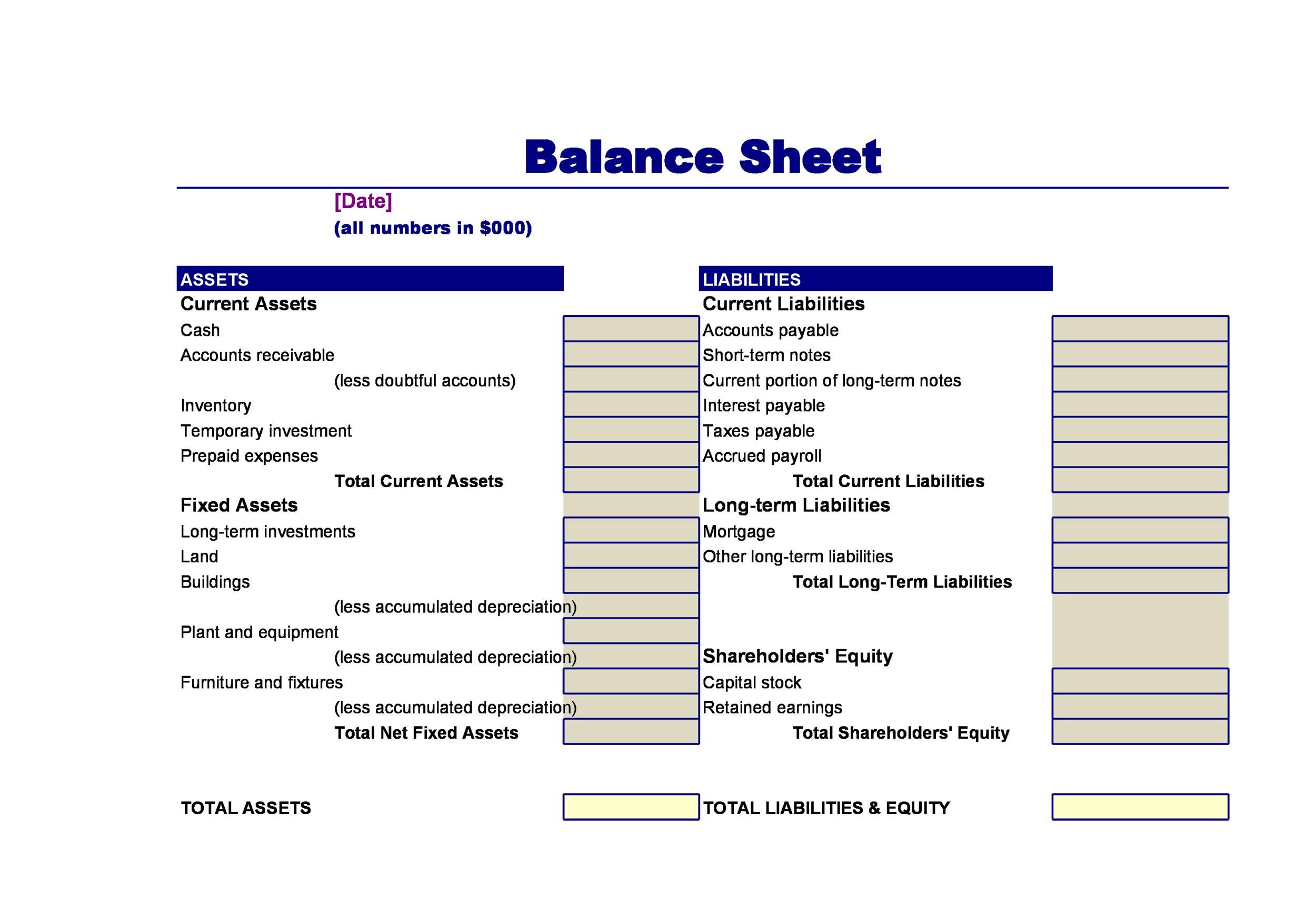

s corp balance sheet template Lovely What Is a Financial Statement

Near the end of the post, i briefly mentioned schedule l,. Does an s corp have to file a balance sheet? Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. But what if the underlying. Massaging of the equity section of your balance sheet is required when being taxed as.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

But what if the underlying. An s corp balance sheet includes a detailed list of your company's assets and liabilities. Does an s corp have to file a balance sheet? Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. Near the end of the post, i briefly mentioned schedule l,.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

An s corp balance sheet includes a detailed list of your company's assets and liabilities. Does an s corp have to file a balance sheet? Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. But what if the underlying. If your s corp has more than $250,000 in net receipts.

38 Free Balance Sheet Templates & Examples ᐅ TemplateLab

If your s corp has more than $250,000 in net receipts and assets in a given tax year, then. But what if the underlying. Massaging of the equity section of your balance sheet is required when being taxed as an s corporation. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity.

S Corp Balance Sheet Template

Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then. Does an s corp have to file a balance sheet? An s corp balance sheet includes a detailed list of your company's.

22+ Free Balance Sheet Templates in Excel PDF Word

Near the end of the post, i briefly mentioned schedule l,. But what if the underlying. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. Does an s corp have to file a balance sheet? Massaging of the equity section of your balance sheet is required when being taxed as.

Corporate Balance Sheet Template For Your Needs

Near the end of the post, i briefly mentioned schedule l,. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then. An s corp balance sheet includes a detailed list of your company's assets and liabilities. Explore the essential components of an s corp balance sheet with illustrative examples of assets,.

Balance Sheet Template Sheets

An s corp balance sheet includes a detailed list of your company's assets and liabilities. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then. Near the end of the post, i.

38 Free Balance Sheet Templates & Examples Template Lab

An s corp balance sheet includes a detailed list of your company's assets and liabilities. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. Massaging of the equity section of your balance sheet is required when being taxed as an s corporation. Near the end of the post, i briefly.

S Corp Balance Sheet Template Verkanarobtowner

Massaging of the equity section of your balance sheet is required when being taxed as an s corporation. But what if the underlying. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. Does an s corp have to file a balance sheet? An s corp balance sheet includes a detailed.

But What If The Underlying.

Near the end of the post, i briefly mentioned schedule l,. Massaging of the equity section of your balance sheet is required when being taxed as an s corporation. Explore the essential components of an s corp balance sheet with illustrative examples of assets, liabilities, and equity for. If your s corp has more than $250,000 in net receipts and assets in a given tax year, then.

Does An S Corp Have To File A Balance Sheet?

An s corp balance sheet includes a detailed list of your company's assets and liabilities.