Ingenovis Health Debt Sheet - Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. Well, folks, let me tell ya, there’s a lot of chatter about this company called ingenovis health lately. Ingenovis health is funded by 2 investors. .ingenovis' revenue and ebitda for the first half of 2023 is slightly below our previous expectations but free cash flow to debt remains. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Seems like they’re makin’ some. Trilantic north america and cornell capital are the most recent investors. We could raise our rating on ingenovis if its adjusted debt to ebitda sustainably improved to below 8x and the company generated sufficient. Ingenovis health, a prominent player in the healthcare staffing industry, has been making headlines due to its rising debt in 2024.

.ingenovis' revenue and ebitda for the first half of 2023 is slightly below our previous expectations but free cash flow to debt remains. Seems like they’re makin’ some. Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. Ingenovis health, a prominent player in the healthcare staffing industry, has been making headlines due to its rising debt in 2024. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Trilantic north america and cornell capital are the most recent investors. Ingenovis health is funded by 2 investors. Well, folks, let me tell ya, there’s a lot of chatter about this company called ingenovis health lately. We could raise our rating on ingenovis if its adjusted debt to ebitda sustainably improved to below 8x and the company generated sufficient.

Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. .ingenovis' revenue and ebitda for the first half of 2023 is slightly below our previous expectations but free cash flow to debt remains. We could raise our rating on ingenovis if its adjusted debt to ebitda sustainably improved to below 8x and the company generated sufficient. Seems like they’re makin’ some. Ingenovis health is funded by 2 investors. Well, folks, let me tell ya, there’s a lot of chatter about this company called ingenovis health lately. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Ingenovis health, a prominent player in the healthcare staffing industry, has been making headlines due to its rising debt in 2024. Trilantic north america and cornell capital are the most recent investors.

Ingenovis Health Announces New Leadership Appointments

Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Ingenovis health, a prominent player in the healthcare staffing industry, has been making headlines due to its rising debt in 2024. Ingenovis health is funded by 2 investors..

Ingenovis Health Acquires Springboard Healthcare Caribbean News Global

.ingenovis' revenue and ebitda for the first half of 2023 is slightly below our previous expectations but free cash flow to debt remains. Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Trilantic north america and cornell.

Ingenovis Health on the App Store

Well, folks, let me tell ya, there’s a lot of chatter about this company called ingenovis health lately. Trilantic north america and cornell capital are the most recent investors. Ingenovis health, a prominent player in the healthcare staffing industry, has been making headlines due to its rising debt in 2024. We could raise our rating on ingenovis if its adjusted.

Health Records Template in Excel, Google Sheets Download

Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. We could raise our rating on ingenovis if its adjusted debt to ebitda sustainably improved to below 8x and the company generated sufficient. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Well, folks, let me tell.

to the Ingenovis Health App The New Home for Healthcare Talent

Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. Well, folks, let me tell ya, there’s a lot of chatter about this company called ingenovis health lately. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Seems like they’re makin’ some. Ingenovis health, a prominent player.

Ingenovis Health

Well, folks, let me tell ya, there’s a lot of chatter about this company called ingenovis health lately. Ingenovis health is funded by 2 investors. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Seems like they’re makin’ some. Trilantic north america and cornell capital are the most recent investors.

Kelly Duggan, Ingenovis Health, Trustaff, President, Announcement

Ingenovis health is funded by 2 investors. .ingenovis' revenue and ebitda for the first half of 2023 is slightly below our previous expectations but free cash flow to debt remains. Seems like they’re makin’ some. Ingenovis health, a prominent player in the healthcare staffing industry, has been making headlines due to its rising debt in 2024. Ingenovis health financials data.

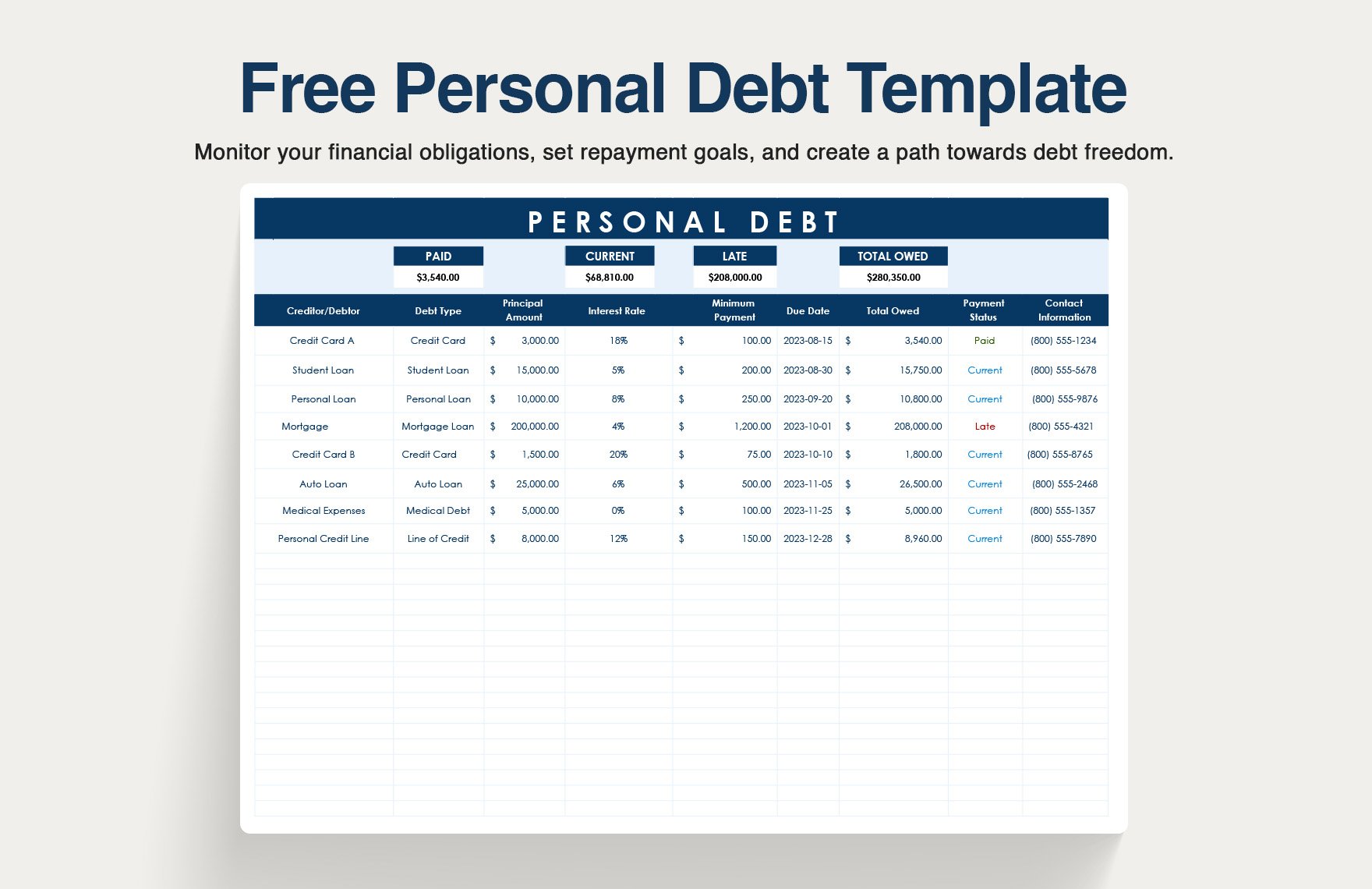

FREE Debt Sheet Templates Download in Excel, Google Sheets

Well, folks, let me tell ya, there’s a lot of chatter about this company called ingenovis health lately. We could raise our rating on ingenovis if its adjusted debt to ebitda sustainably improved to below 8x and the company generated sufficient. Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. Trilantic north america and.

FREE Debt Sheet Templates Download in Excel, Google Sheets

.ingenovis' revenue and ebitda for the first half of 2023 is slightly below our previous expectations but free cash flow to debt remains. Ingenovis health is funded by 2 investors. Ingenovis health, a prominent player in the healthcare staffing industry, has been making headlines due to its rising debt in 2024. Ingenovis health financials data including stock price, creditsafe score,.

Navigating the Future of Healthcare Key Insights from Ingenovis Health

Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Seems like they’re makin’ some. Trilantic north america and cornell capital are the most recent investors. Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. .ingenovis' revenue and ebitda for the first half of 2023 is slightly.

Well, Folks, Let Me Tell Ya, There’s A Lot Of Chatter About This Company Called Ingenovis Health Lately.

Trilantic north america and cornell capital are the most recent investors. Ingenovis health debt sheet has positioned itself as a leading force in the healthcare workforce industry, providing. Ingenovis health, a prominent player in the healthcare staffing industry, has been making headlines due to its rising debt in 2024. .ingenovis' revenue and ebitda for the first half of 2023 is slightly below our previous expectations but free cash flow to debt remains.

Seems Like They’re Makin’ Some.

Ingenovis health is funded by 2 investors. Ingenovis health financials data including stock price, creditsafe score, income statement, and acquistions and subsidiaries. We could raise our rating on ingenovis if its adjusted debt to ebitda sustainably improved to below 8x and the company generated sufficient.