Estate Planning Fee Sheet - For your estate planning needs. It avoids probate and allows the. Estate planning lawyers typically charge a flat fee, hourly fee, or more rarely, a contingency fee. Complex wills involving testamentary trusts or other complications may require an additional fee. If such a plan is necessary, your. My fee quote will combine one of the essential base fee amounts plus any premium options you. Here's a breakdown of some of the costs involved when planning and organizing your. This plan is for married couples with assets over either the state or federal estate tax exemption limits. A flat fee is a fixed charge for. Thank you for considering dovetail estate planning p.c.

Here's a breakdown of some of the costs involved when planning and organizing your. Complex wills involving testamentary trusts or other complications may require an additional fee. A flat fee is a fixed charge for. How to calculate the total fee: This plan is for married couples with assets over either the state or federal estate tax exemption limits. It avoids probate and allows the. Estate planning lawyers typically charge a flat fee, hourly fee, or more rarely, a contingency fee. My fee quote will combine one of the essential base fee amounts plus any premium options you. If such a plan is necessary, your. Do you know what estate planning costs?

A flat fee is a fixed charge for. How to calculate the total fee: For your estate planning needs. My fee quote will combine one of the essential base fee amounts plus any premium options you. Thank you for considering dovetail estate planning p.c. This plan is for married couples with assets over either the state or federal estate tax exemption limits. Here's a breakdown of some of the costs involved when planning and organizing your. It avoids probate and allows the. Do you know what estate planning costs? If such a plan is necessary, your.

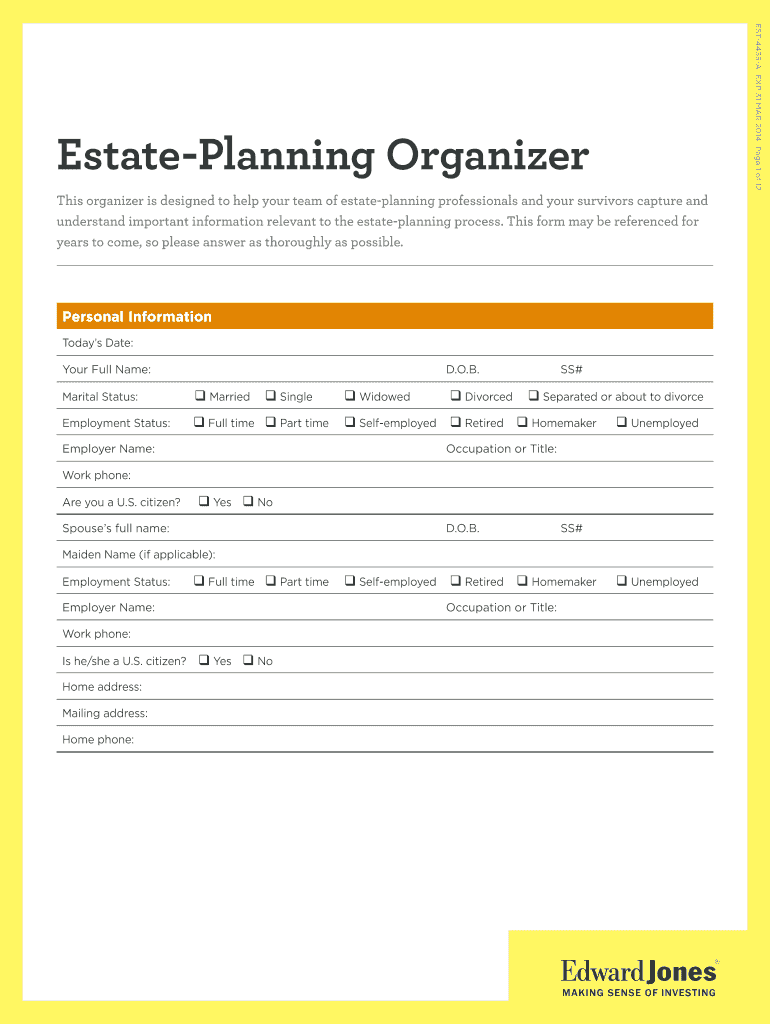

Est4435 Estate Planning Complete with ease airSlate SignNow

Here's a breakdown of some of the costs involved when planning and organizing your. How to calculate the total fee: Thank you for considering dovetail estate planning p.c. Do you know what estate planning costs? A flat fee is a fixed charge for.

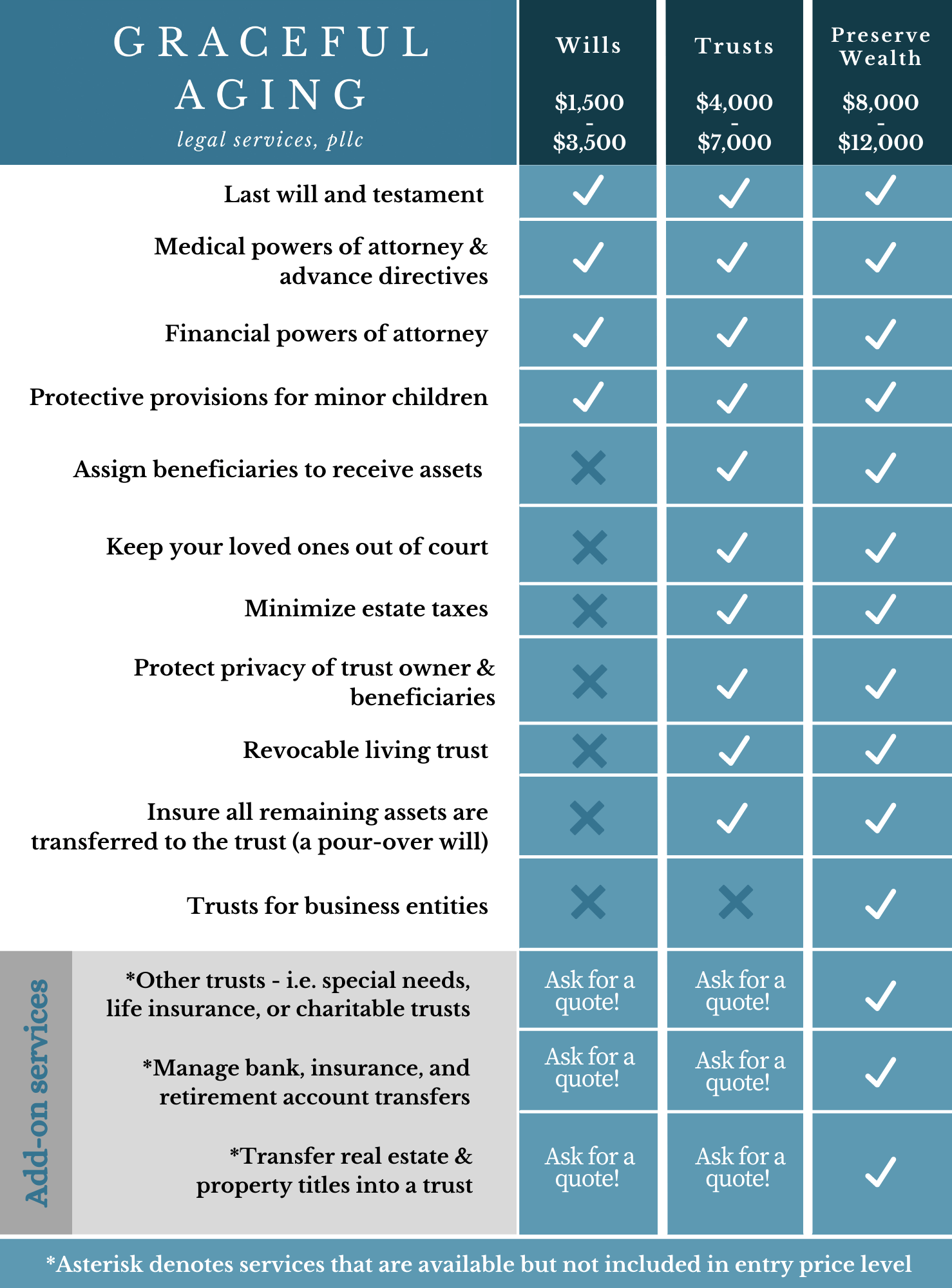

Estate Planning Fees Weston Legal

For your estate planning needs. Here's a breakdown of some of the costs involved when planning and organizing your. Complex wills involving testamentary trusts or other complications may require an additional fee. It avoids probate and allows the. My fee quote will combine one of the essential base fee amounts plus any premium options you.

Fees and Pricing

Here's a breakdown of some of the costs involved when planning and organizing your. Estate planning lawyers typically charge a flat fee, hourly fee, or more rarely, a contingency fee. This plan is for married couples with assets over either the state or federal estate tax exemption limits. If such a plan is necessary, your. Do you know what estate.

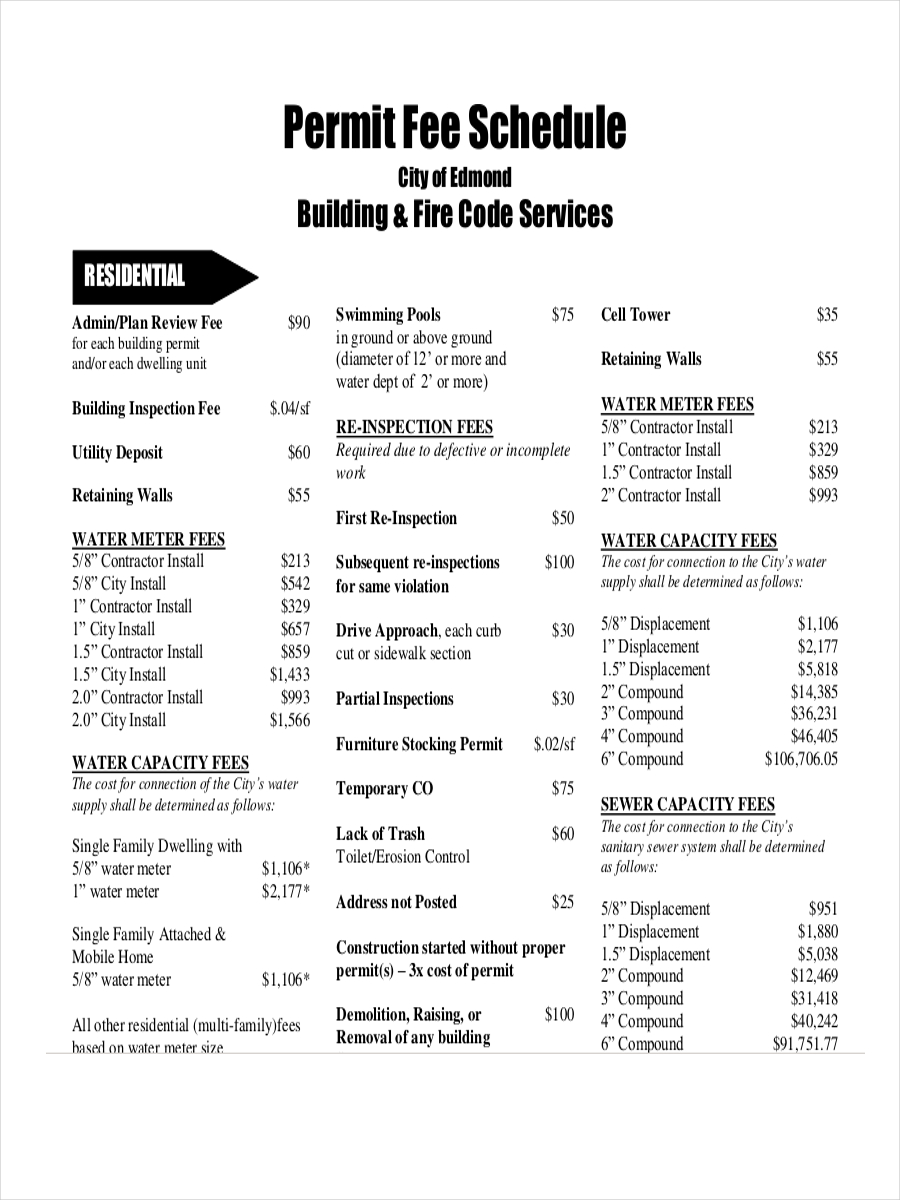

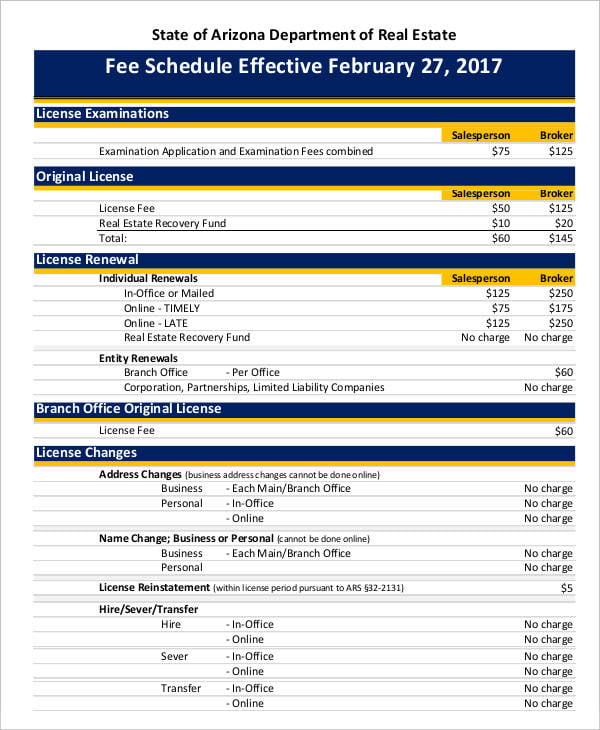

7+ Fee Schedule Examples to Download

This plan is for married couples with assets over either the state or federal estate tax exemption limits. How to calculate the total fee: Complex wills involving testamentary trusts or other complications may require an additional fee. If such a plan is necessary, your. Do you know what estate planning costs?

Fees and Pricing

How to calculate the total fee: It avoids probate and allows the. Here's a breakdown of some of the costs involved when planning and organizing your. Complex wills involving testamentary trusts or other complications may require an additional fee. Estate planning lawyers typically charge a flat fee, hourly fee, or more rarely, a contingency fee.

Estate Planning Checklist and Asset Inventory Worksheet The Ashmore

Thank you for considering dovetail estate planning p.c. How to calculate the total fee: If such a plan is necessary, your. Here's a breakdown of some of the costs involved when planning and organizing your. Estate planning lawyers typically charge a flat fee, hourly fee, or more rarely, a contingency fee.

Free Rental Housing Fee Schedule Templates For Google Sheets And

My fee quote will combine one of the essential base fee amounts plus any premium options you. If such a plan is necessary, your. For your estate planning needs. Thank you for considering dovetail estate planning p.c. Here's a breakdown of some of the costs involved when planning and organizing your.

Fee Schedule Graceful Aging

This plan is for married couples with assets over either the state or federal estate tax exemption limits. How to calculate the total fee: For your estate planning needs. My fee quote will combine one of the essential base fee amounts plus any premium options you. Here's a breakdown of some of the costs involved when planning and organizing your.

6+ Fee Schedule Templates Free Samples, Examples Format Download

Complex wills involving testamentary trusts or other complications may require an additional fee. Thank you for considering dovetail estate planning p.c. Estate planning lawyers typically charge a flat fee, hourly fee, or more rarely, a contingency fee. How to calculate the total fee: Here's a breakdown of some of the costs involved when planning and organizing your.

Estate Planning Fee Schedule Law Office of Trapp Nicholl

Complex wills involving testamentary trusts or other complications may require an additional fee. My fee quote will combine one of the essential base fee amounts plus any premium options you. How to calculate the total fee: It avoids probate and allows the. If such a plan is necessary, your.

Here's A Breakdown Of Some Of The Costs Involved When Planning And Organizing Your.

Estate planning lawyers typically charge a flat fee, hourly fee, or more rarely, a contingency fee. It avoids probate and allows the. For your estate planning needs. A flat fee is a fixed charge for.

Thank You For Considering Dovetail Estate Planning P.c.

My fee quote will combine one of the essential base fee amounts plus any premium options you. Do you know what estate planning costs? Complex wills involving testamentary trusts or other complications may require an additional fee. This plan is for married couples with assets over either the state or federal estate tax exemption limits.

How To Calculate The Total Fee:

If such a plan is necessary, your.