Discount On Shares In Balance Sheet - When shares are issued at a price lower than their face value, they are said to have been issued at a discount. For example, if a share of rs 100 is. The discount on common stock account is used to record the discount. For example, if a company. The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. When a company issues shares at a price less than their face value, it is said to have issued them at a discount. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. This account is a contra equity account that reduces the common stock.

When a company issues shares at a price less than their face value, it is said to have issued them at a discount. For example, if a company. When shares are issued at a price lower than their face value, they are said to have been issued at a discount. This account is a contra equity account that reduces the common stock. The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. For example, if a share of rs 100 is. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. The discount on common stock account is used to record the discount. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the.

The discount on common stock account is used to record the discount. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. When shares are issued at a price lower than their face value, they are said to have been issued at a discount. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. This account is a contra equity account that reduces the common stock. When a company issues shares at a price less than their face value, it is said to have issued them at a discount. For example, if a company. For example, if a share of rs 100 is.

Consolidated Balance Sheet and Steps to Prepare Tally Solutions

Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. The discount on common stock account is used to record the discount. For example, if a share of rs 100 is. The discount amount is recorded separately in the books as a “discount.

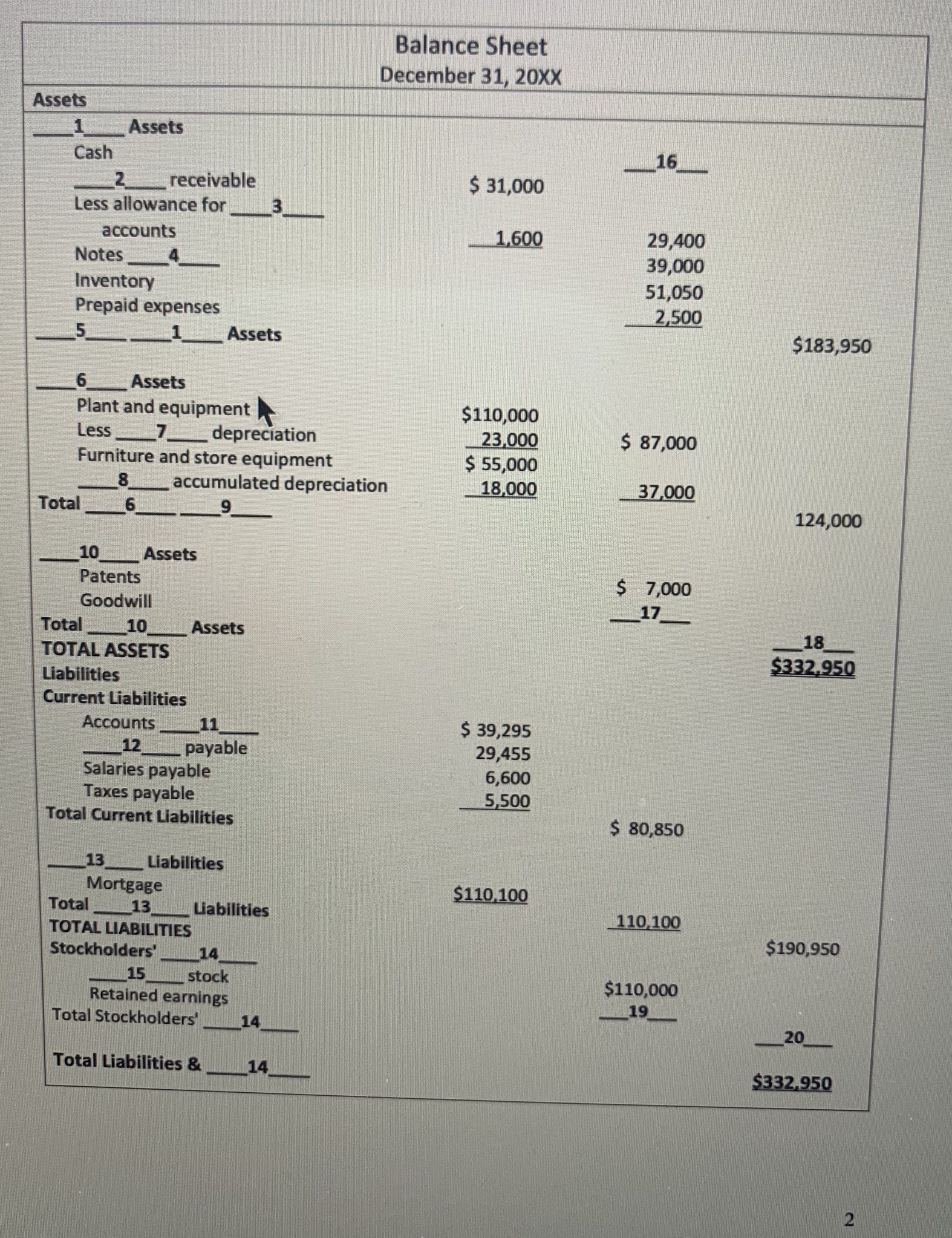

Answered Balance Sheet December 31, 20XX Assets… bartleby

For example, if a company. When shares are issued at a price lower than their face value, they are said to have been issued at a discount. The discount on common stock account is used to record the discount. When a company issues shares at a price less than their face value, it is said to have issued them at.

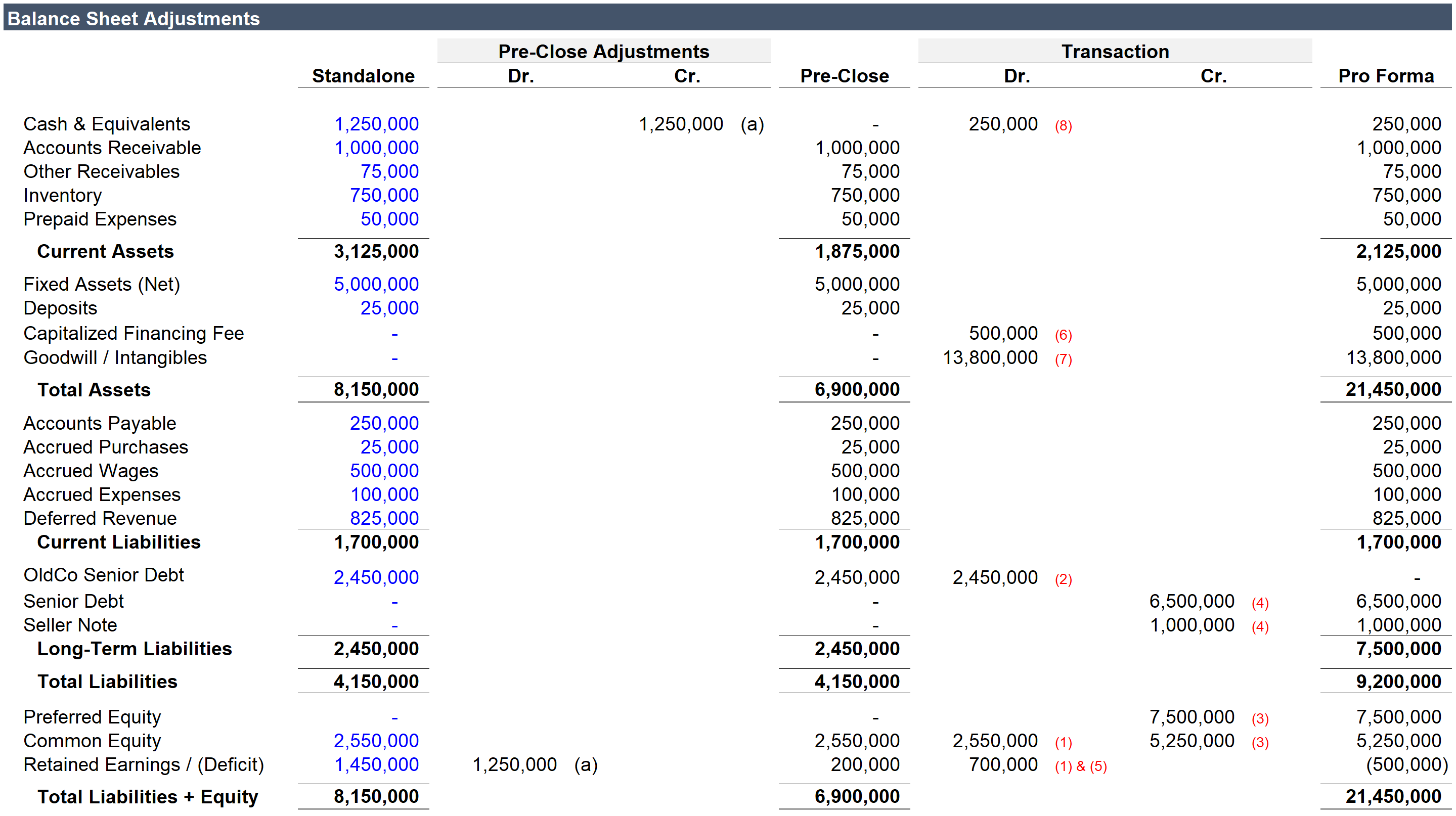

LBO Pro Forma Balance Sheet Adjustments A Simple Model

This account is a contra equity account that reduces the common stock. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. For example, if a company. The.

Following was the Balance sheet of M.M.Ltd at on 31.3.2015 Refer image

For example, if a share of rs 100 is. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. This account is a contra equity account that reduces the common stock. The discount on common stock account is used to record the discount. When shares are issued at a price lower than their face value,.

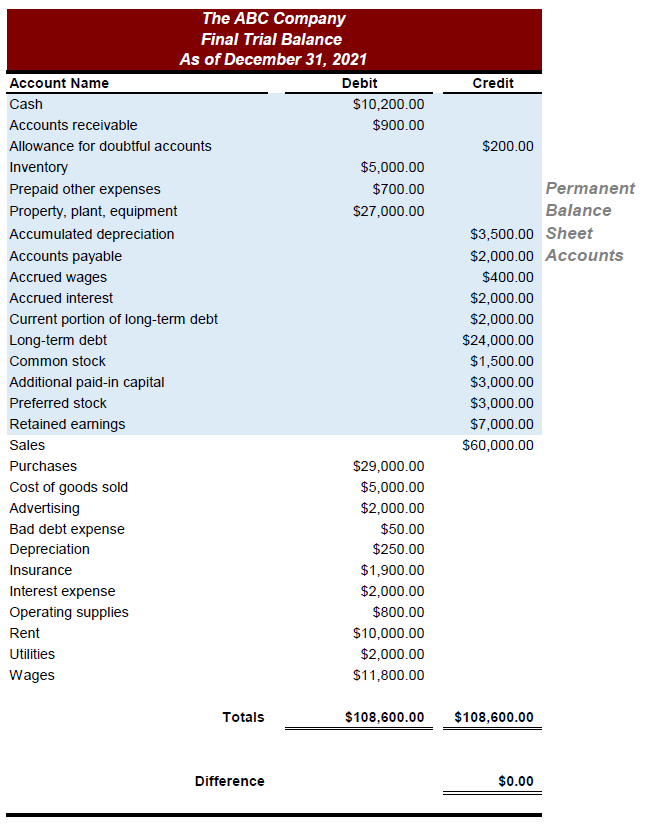

Balance sheet example track assets and liabilities

For example, if a company. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. The discount on common stock account is used to record the discount. When a company issues shares at a price less than their face value, it is said.

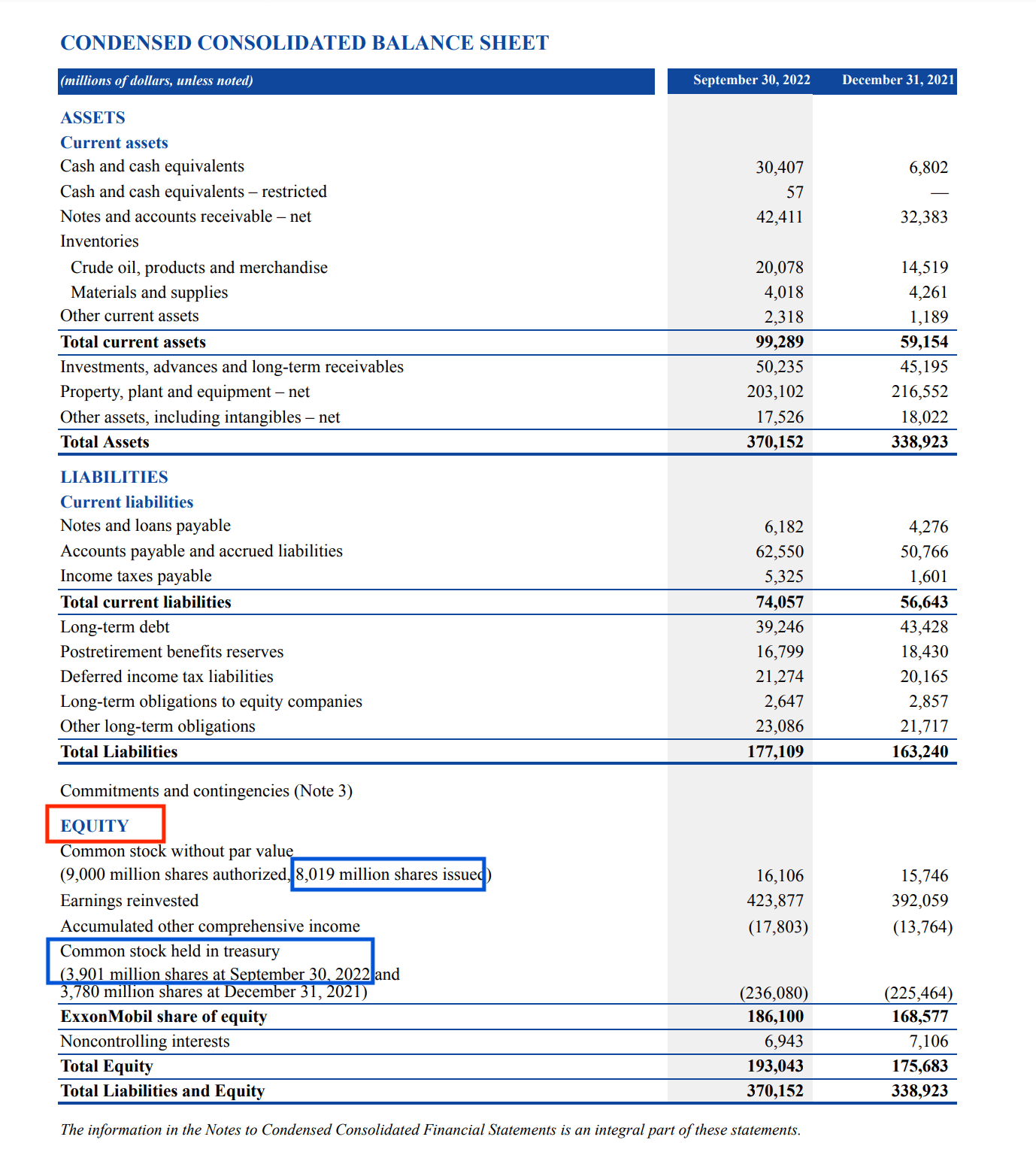

Shares Outstanding Types, How to Find, and Float Stock Analysis

Learn issue of shares journal entries with example for par, premium, discount & bonus shares. When a company issues shares at a price less than their face value, it is said to have issued them at a discount. The discount on common stock account is used to record the discount. For example, if a share of rs 100 is. Discount.

Accounting Entries on Reissue of Forfeited Shares

This account is a contra equity account that reduces the common stock. For example, if a company. The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. When a company issues shares at.

Issue of Debentures Accounting Treatment of Issue of Debenture and

Learn issue of shares journal entries with example for par, premium, discount & bonus shares. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. For example, if a company. The discount amount is recorded separately in the books as a “discount on.

Share Capital Problems and Solutions Accountancy Knowledge

This account is a contra equity account that reduces the common stock. For example, if a share of rs 100 is. The discount on common stock account is used to record the discount. When shares are issued at a price lower than their face value, they are said to have been issued at a discount. Learn issue of shares journal.

How To Prepare a Balance Sheet A StepbyStep Guide Capterra

For example, if a company. The discount on common stock account is used to record the discount. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. This account is a contra equity account that reduces the common stock. Learn issue of shares.

For Example, If A Company.

When shares are issued at a price lower than their face value, they are said to have been issued at a discount. Discount on issue of shares being a capital loss to a company, should be debited to “discount on shares account” and shown as an asset in the. The discount on common stock account is used to record the discount. This account is a contra equity account that reduces the common stock.

When A Company Issues Shares At A Price Less Than Their Face Value, It Is Said To Have Issued Them At A Discount.

The discount amount is recorded separately in the books as a “discount on issue of shares” and is considered a capital loss. Learn issue of shares journal entries with example for par, premium, discount & bonus shares. For example, if a share of rs 100 is.