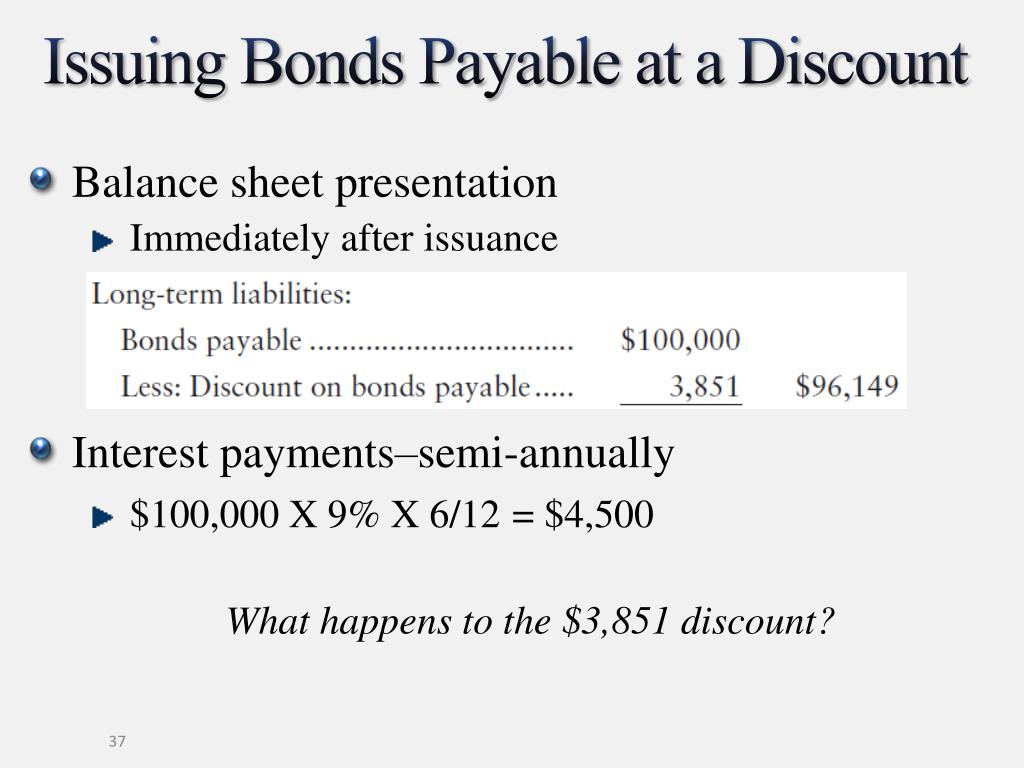

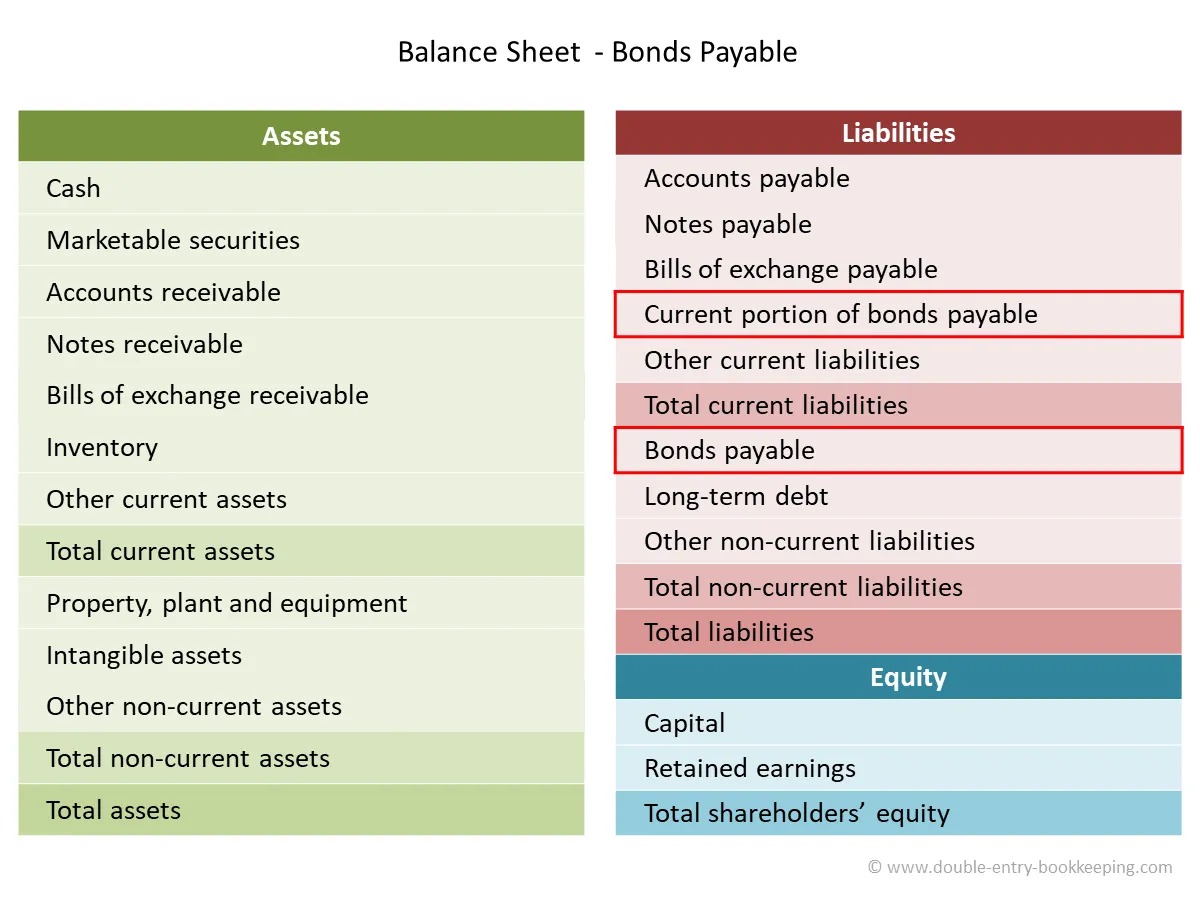

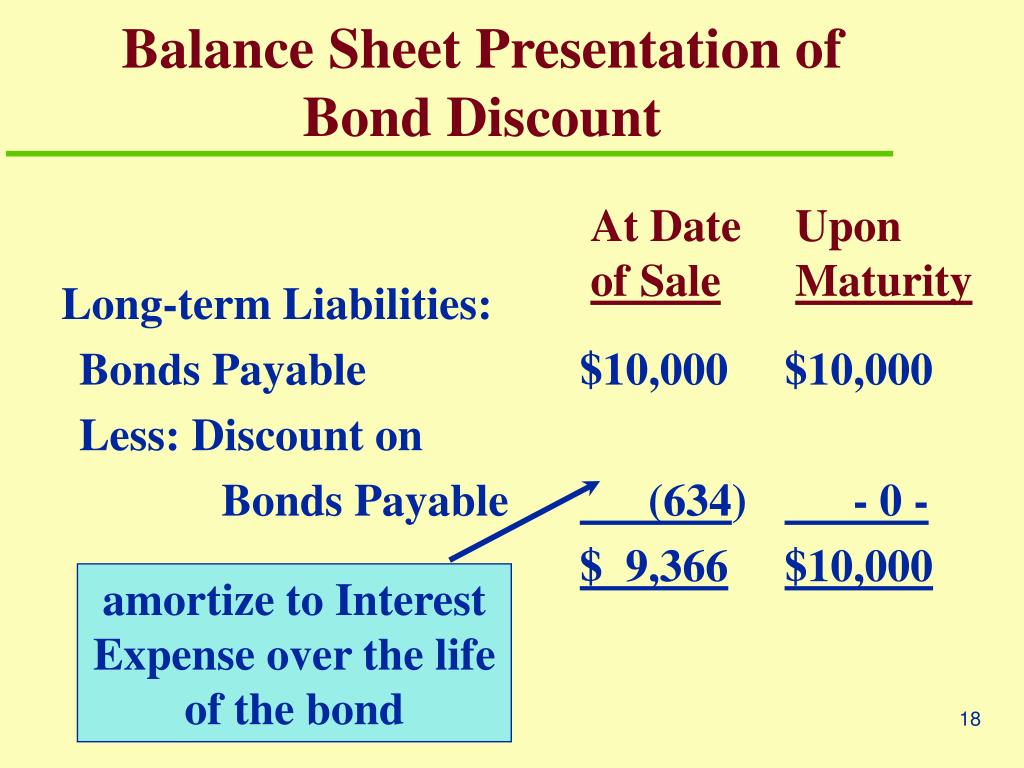

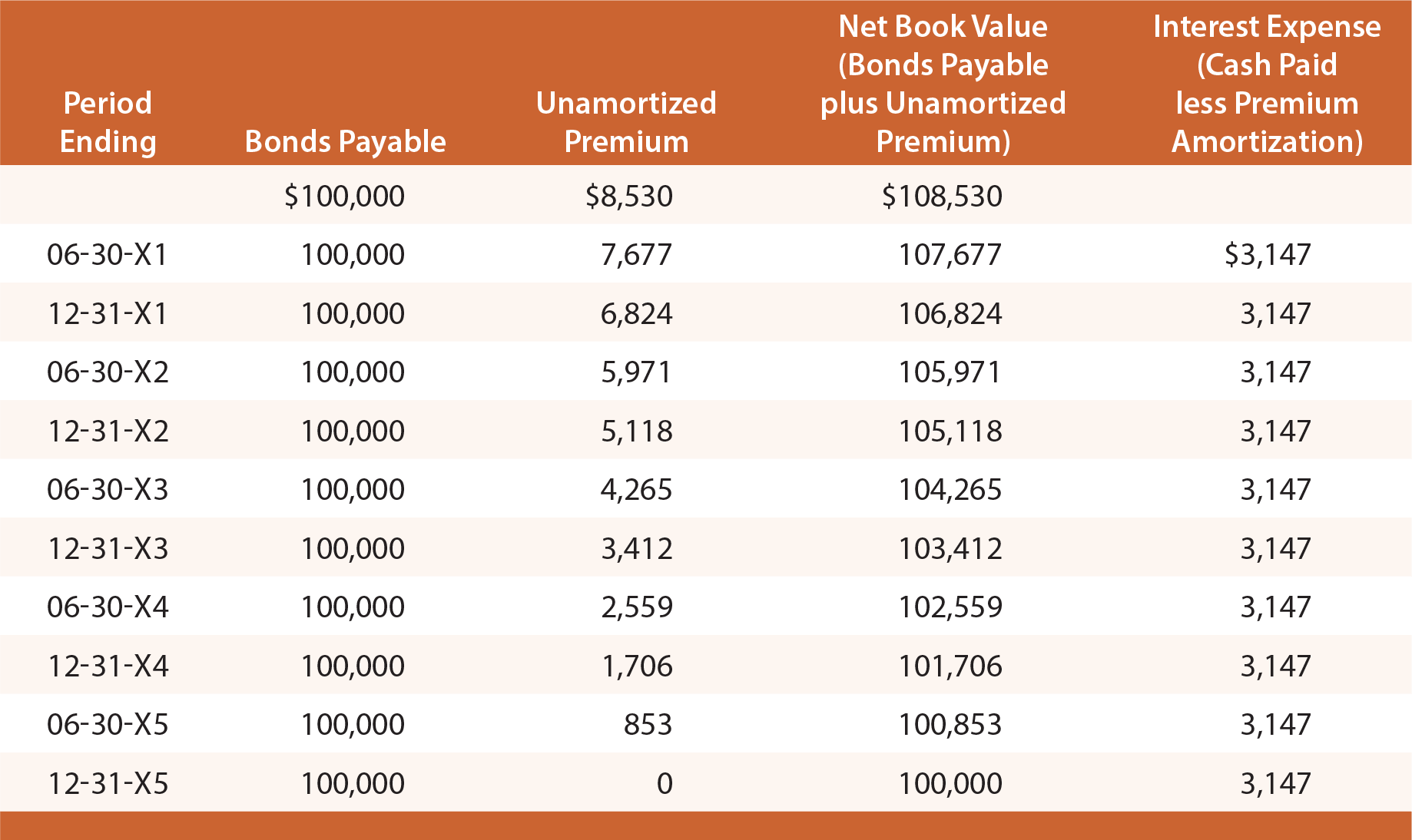

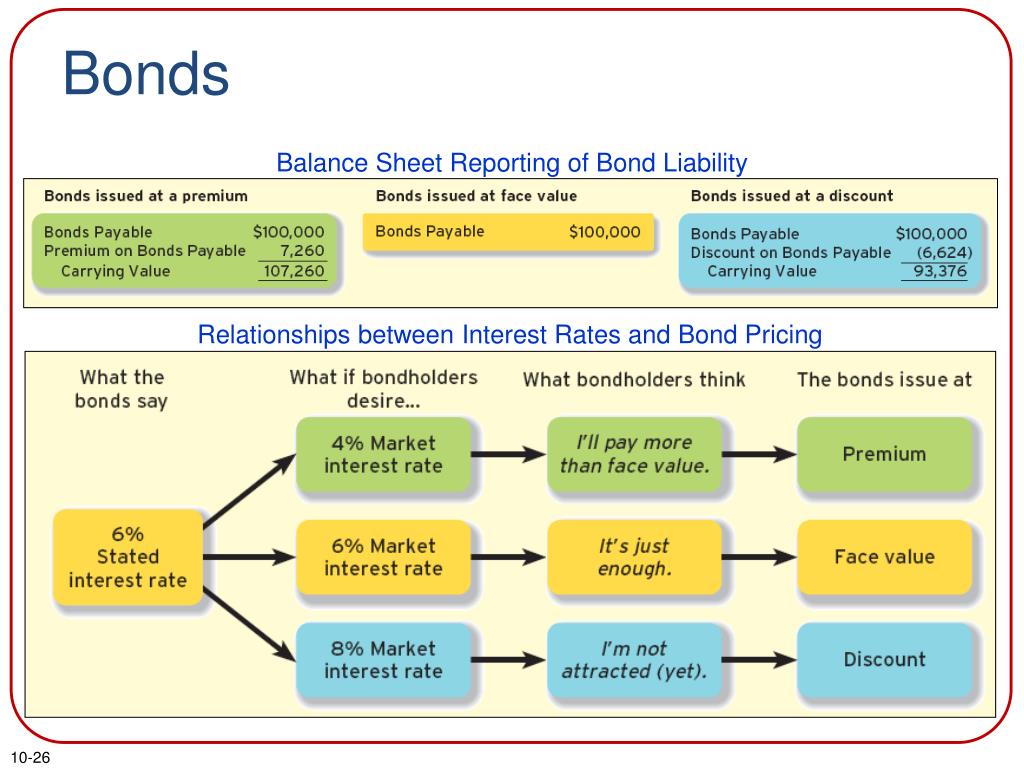

Bonds On Balance Sheet - On maturity, due to amortization of. If interest dates fall on other than balance sheet dates,. On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance (known as an “adjunct” account). The purpose of this article is to provide a brief overview of these. This carrying amount of bonds payable on balance sheet is what the issuer will get from the investor when the bond is issued. They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is. When a bond is issued, the issuer records the face value of the bond as the bonds payable. Investments in bonds can generate a multitude of accounting treatments and may be puzzling to accounting students.

When a bond is issued, the issuer records the face value of the bond as the bonds payable. On maturity, due to amortization of. If interest dates fall on other than balance sheet dates,. On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance (known as an “adjunct” account). This carrying amount of bonds payable on balance sheet is what the issuer will get from the investor when the bond is issued. The purpose of this article is to provide a brief overview of these. They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is. Investments in bonds can generate a multitude of accounting treatments and may be puzzling to accounting students.

On maturity, due to amortization of. They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is. Investments in bonds can generate a multitude of accounting treatments and may be puzzling to accounting students. The purpose of this article is to provide a brief overview of these. If interest dates fall on other than balance sheet dates,. This carrying amount of bonds payable on balance sheet is what the issuer will get from the investor when the bond is issued. When a bond is issued, the issuer records the face value of the bond as the bonds payable. On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance (known as an “adjunct” account).

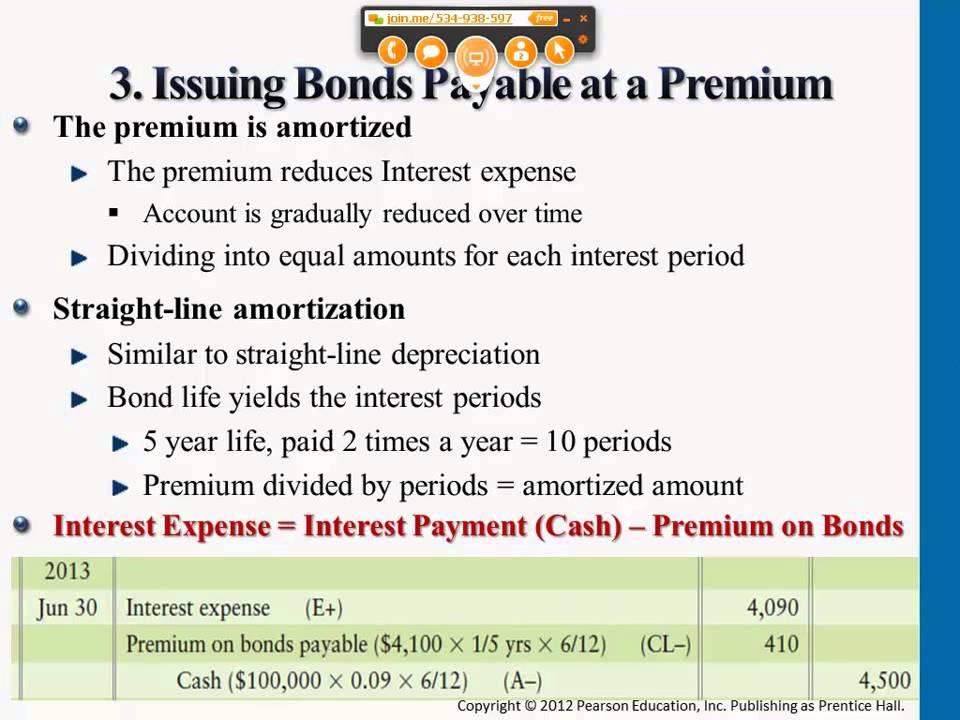

Bonds Payable at Premium Balance Sheet Presentation YouTube

On maturity, due to amortization of. This carrying amount of bonds payable on balance sheet is what the issuer will get from the investor when the bond is issued. The purpose of this article is to provide a brief overview of these. When a bond is issued, the issuer records the face value of the bond as the bonds payable..

Bond Sinking Fund On Balance Sheet amulette

The purpose of this article is to provide a brief overview of these. They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is. On maturity, due to amortization of. On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance.

PPT LongTerm Liabilities , Bonds Payable, and Classification of

On maturity, due to amortization of. The purpose of this article is to provide a brief overview of these. This carrying amount of bonds payable on balance sheet is what the issuer will get from the investor when the bond is issued. If interest dates fall on other than balance sheet dates,. When a bond is issued, the issuer records.

What Is Bonds Payable On A Balance Sheet LiveWell

The purpose of this article is to provide a brief overview of these. This carrying amount of bonds payable on balance sheet is what the issuer will get from the investor when the bond is issued. Investments in bonds can generate a multitude of accounting treatments and may be puzzling to accounting students. They receive cash for the fair value.

PPT LongTerm Liabilities in Financial Accounting PowerPoint

When a bond is issued, the issuer records the face value of the bond as the bonds payable. If interest dates fall on other than balance sheet dates,. On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance (known as an “adjunct” account). On maturity, due to.

Bond Related Accounts on the Balance Sheet Wize University

When a bond is issued, the issuer records the face value of the bond as the bonds payable. If interest dates fall on other than balance sheet dates,. On maturity, due to amortization of. The purpose of this article is to provide a brief overview of these. On any given financial statement date, bonds payable is reported on the balance.

Accounting For Bonds Payable

On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance (known as an “adjunct” account). This carrying amount of bonds payable on balance sheet is what the issuer will get from the investor when the bond is issued. Investments in bonds can generate a multitude of accounting.

Accounting For Bonds Payable

They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is. Investments in bonds can generate a multitude of accounting treatments and may be puzzling to accounting students. If interest dates fall on other than balance sheet dates,. This carrying amount of bonds payable on balance sheet is what the issuer will get.

PPT LongTerm Liabilities , Bonds Payable, and Classification of

On maturity, due to amortization of. Investments in bonds can generate a multitude of accounting treatments and may be puzzling to accounting students. On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance (known as an “adjunct” account). The purpose of this article is to provide a.

PPT Chapter 10 PowerPoint Presentation, free download ID4102794

They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is. On maturity, due to amortization of. On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance (known as an “adjunct” account). If interest dates fall on other than balance.

The Purpose Of This Article Is To Provide A Brief Overview Of These.

This carrying amount of bonds payable on balance sheet is what the issuer will get from the investor when the bond is issued. On any given financial statement date, bonds payable is reported on the balance sheet as a liability, along with the unamortized premium balance (known as an “adjunct” account). They receive cash for the fair value of the bond, and the positive (negative) difference (if any) is. On maturity, due to amortization of.

If Interest Dates Fall On Other Than Balance Sheet Dates,.

When a bond is issued, the issuer records the face value of the bond as the bonds payable. Investments in bonds can generate a multitude of accounting treatments and may be puzzling to accounting students.