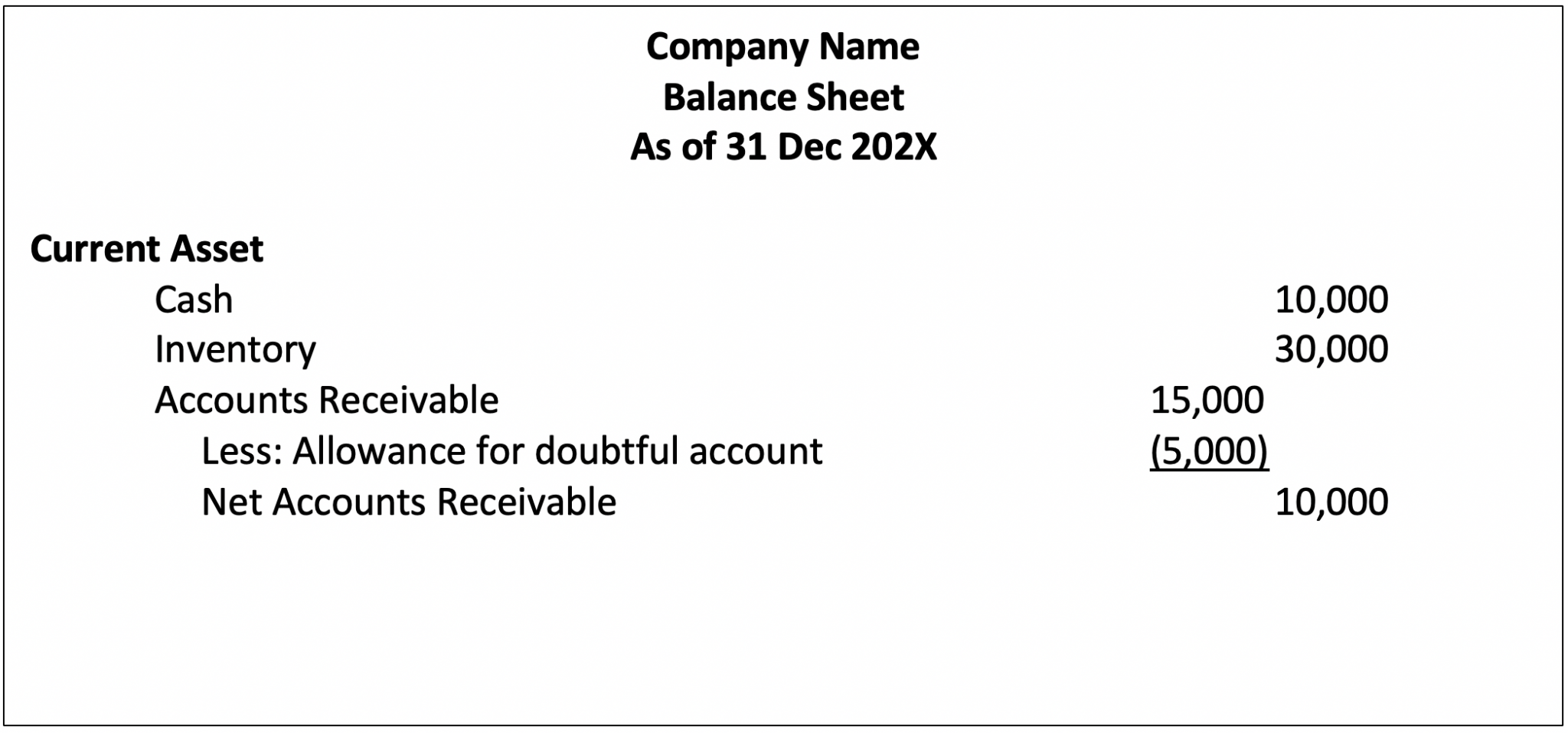

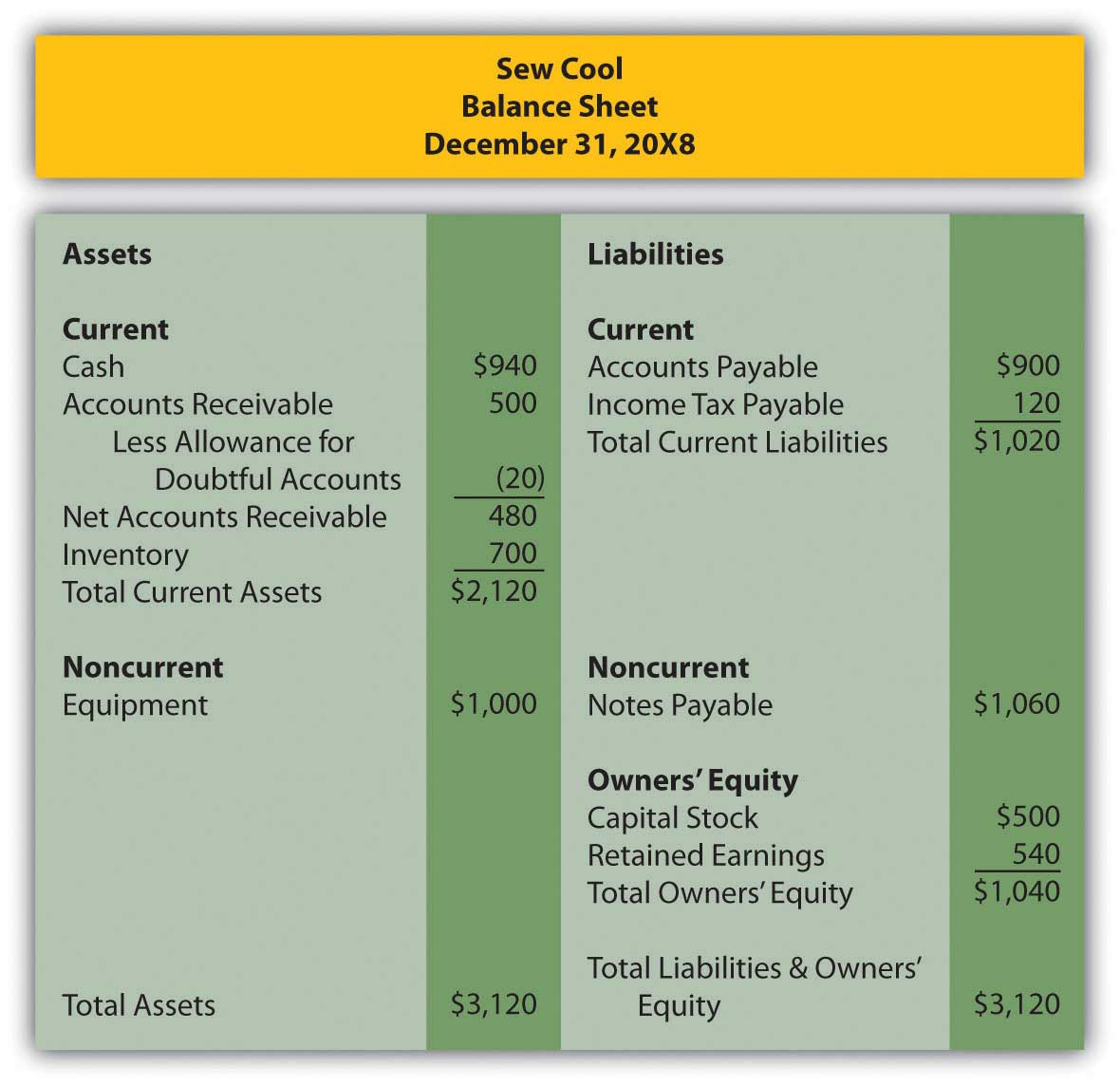

Allowance Of Bad Debt On Balance Sheet - A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry. With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables.

A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry. With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables.

A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry. With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables.

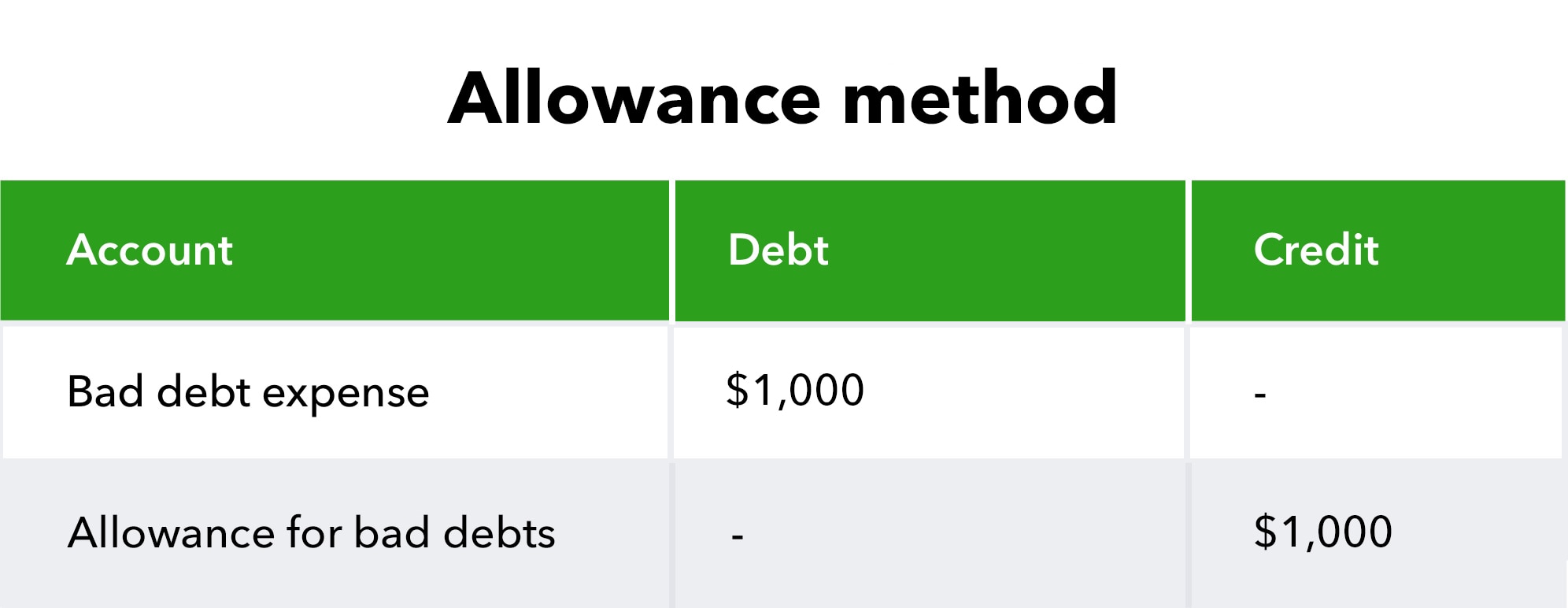

How to calculate and record the bad debt expense QuickBooks

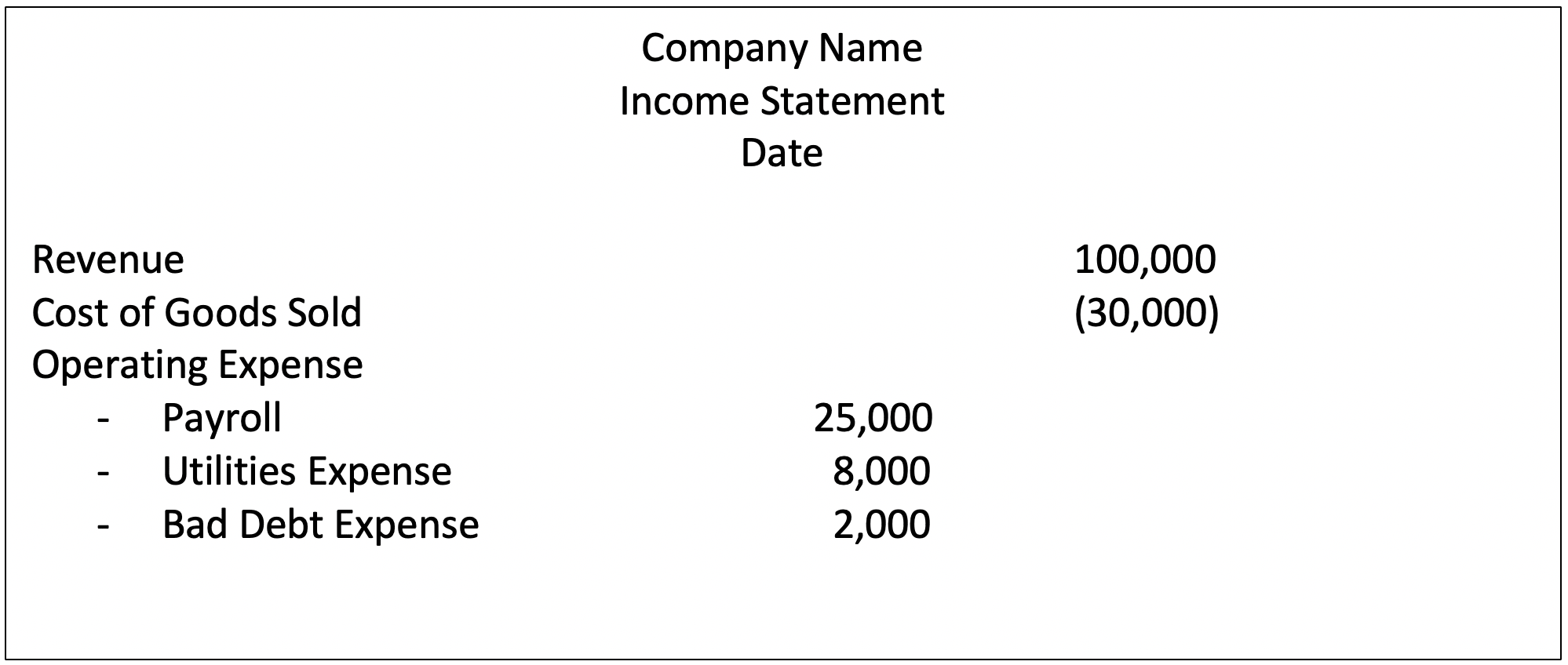

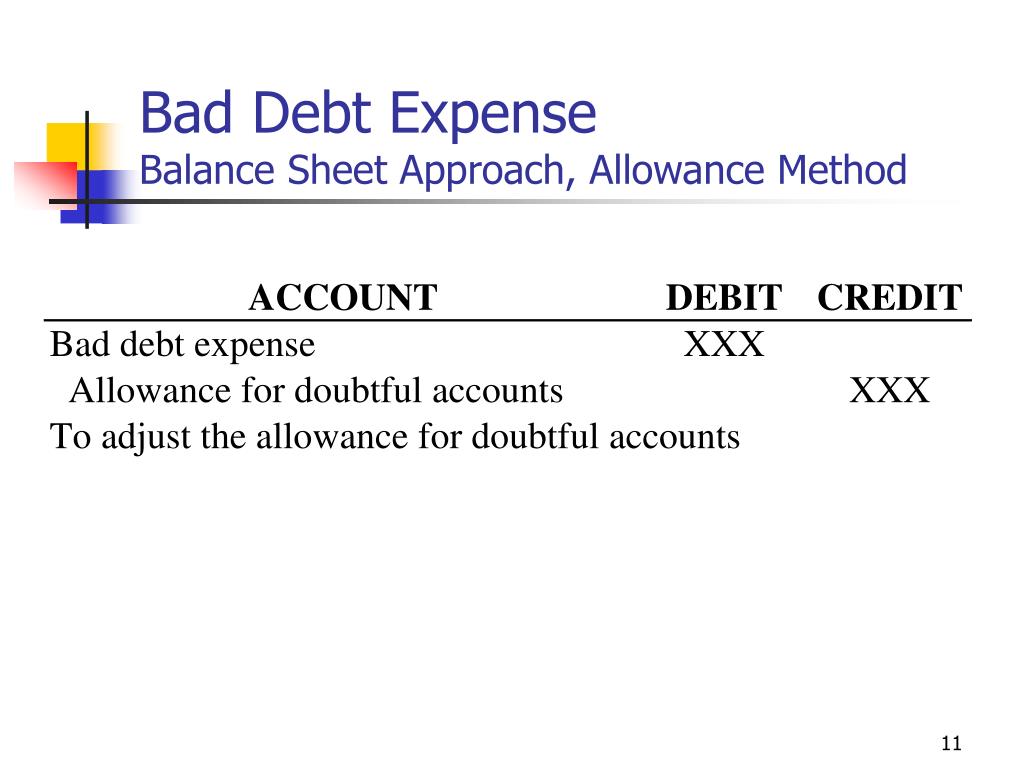

Recording bad debt involves a debit and a credit entry. With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables. A debit entry is made to a bad debt expense.

Bad Debt Expense Definition and Methods for Estimating

With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables. A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry.

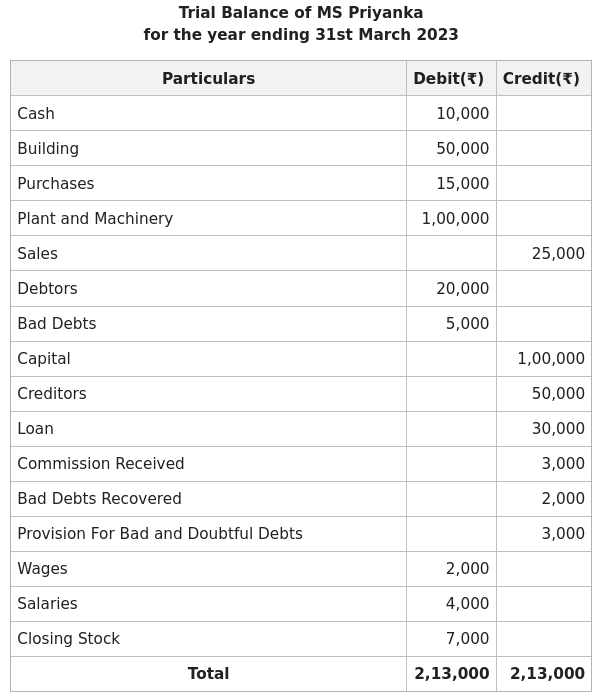

Adjustment of Bad Debts Recovered in Final Accounts (Financial

With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables. A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry.

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

A debit entry is made to a bad debt expense. With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables. Recording bad debt involves a debit and a credit entry.

Bad Debt Expense and Allowance for Doubtful Account Accountinguide

Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense. With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables.

Basics of Accounting/165/Where to show the Provision for Bad Debts in

With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables. A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry.

How to Show Bad Debts in Balance Sheet?

A debit entry is made to a bad debt expense. Recording bad debt involves a debit and a credit entry. With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables.

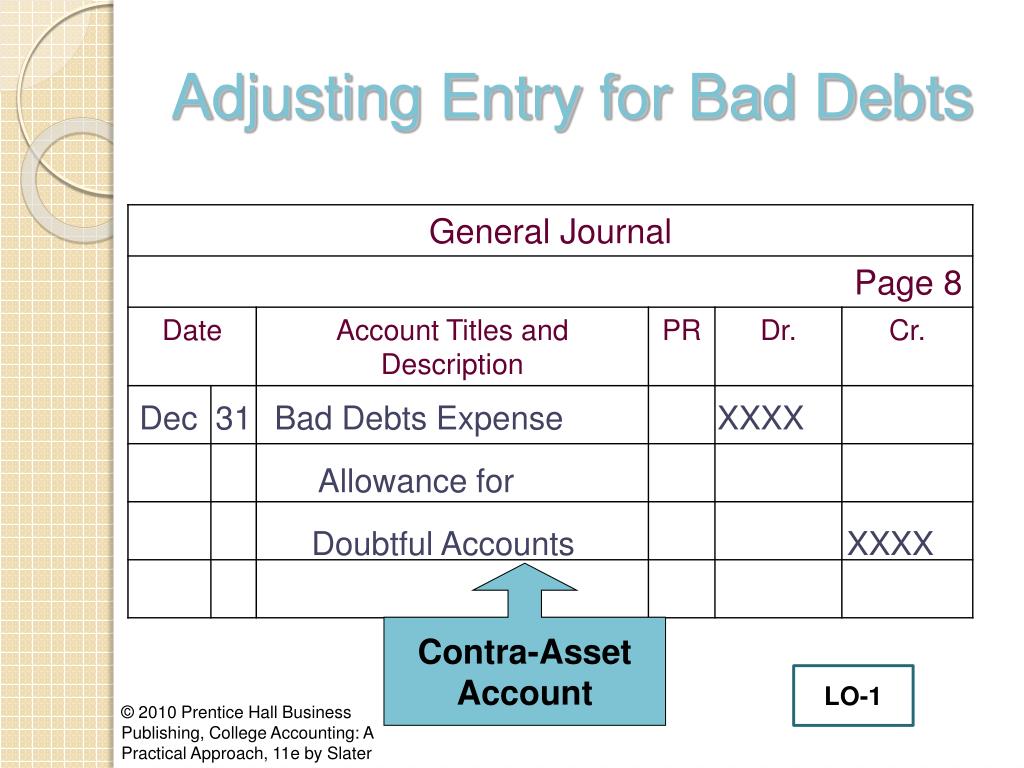

Adjusting Entries Bad Debt Expense

With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables. Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense.

PPT Accounting for Bad Debts PowerPoint Presentation, free download

With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables. Recording bad debt involves a debit and a credit entry. A debit entry is made to a bad debt expense.

A Debit Entry Is Made To A Bad Debt Expense.

Recording bad debt involves a debit and a credit entry. With the allowance method, allowance for doubtful accounts is recognized in the balance sheet as the contra account to receivables.

:max_bytes(150000):strip_icc()/AmazonBS-33b2e9c06fff4e63983e63ae9243141c.JPG)